unemployment tax break refund status

The IRS announced earlier this month that the agency had begun the process of adjusting tax. 22 2022 Published 742 am.

Q A The 10 200 Unemployment Tax Break Abip

New Jersey State Tax Refund Status Information.

. The 10200 is the amount of income exclusion for single filers not the amount of. Use the NJ Refund Status link to go to the New Jersey State Income Tax Refund Status Online Tool just have your 2015 Tax folder ready so you can find the required information. Go to My Account and click on RefundDemand.

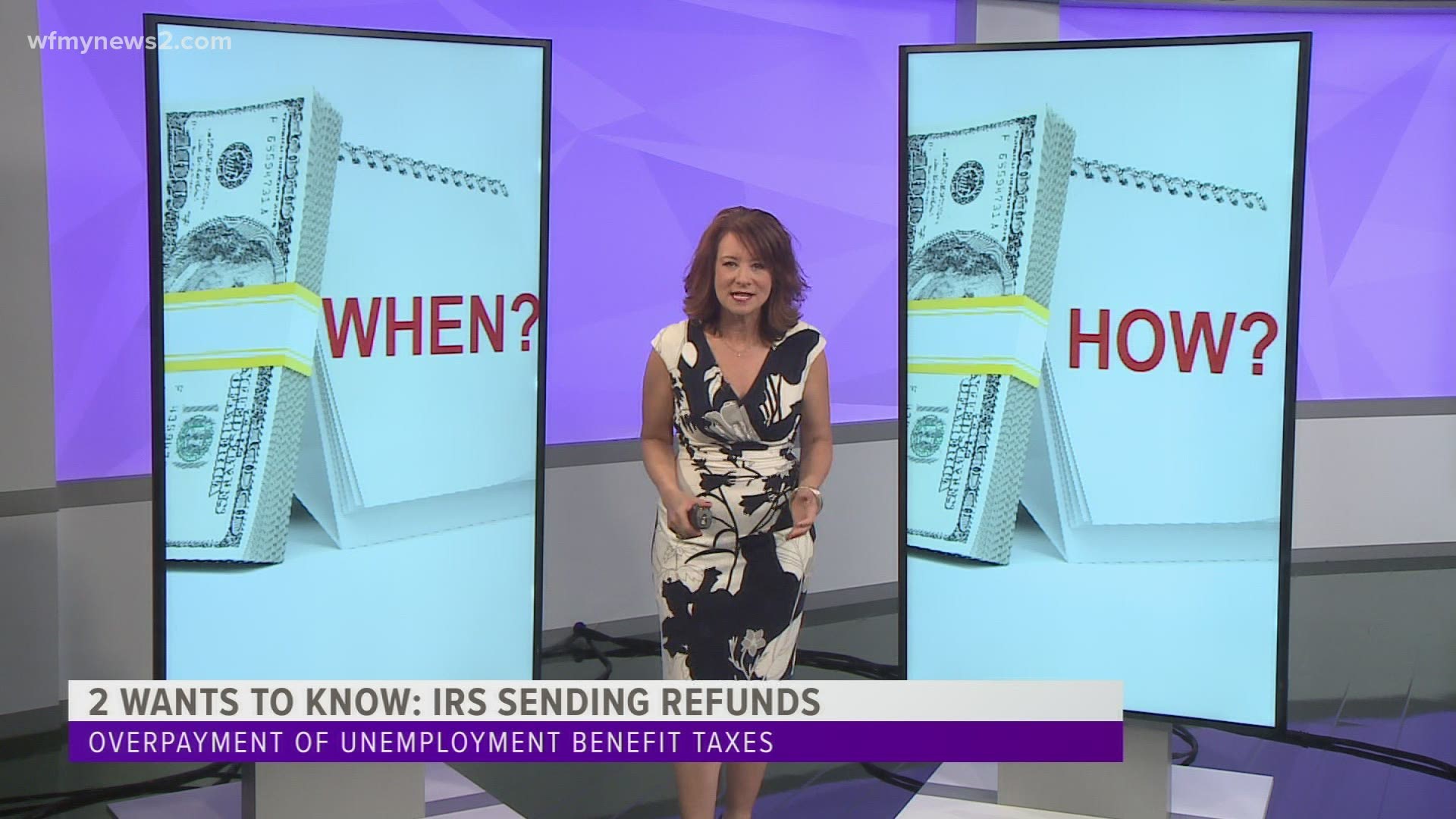

Property Tax Relief Programs. We will begin paying ANCHOR. When Will The Irs Send Refunds For The Unemployment Compensation Tax Break.

By Anuradha Garg. Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

I filed as soon as I could at the end of January and I still havent gotten anything from the state the online tool to check says theyre still. View Refund Demand Status. You wont be able to.

This is the fourth round of refunds related to the unemployment compensation. Unemployment tax refund status. What is the status on the unemployment tax break.

Check the status of your refund through an online tax account. The deadline for filing your ANCHOR benefit application is December 30 2022. Can you track your unemployment tax refund.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. This is available under View Tax Records then click the Get Transcript button. When depends on the complexity of your return.

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. HERES HOW THE 10200 UNEMPLOYMENT TAX BREAK IN BIDENS COVID RELIEF PLAN WORKS Some will receive refunds which will be issued periodically and some will have. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes.

Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and. Another way is to check your tax transcript if you have an online account with the IRS reports CNET. The IRS has just begun May 14 sending out refunds for the.

What You Should Know About Unemployment Tax Refund

Are You Still Waiting For The Unemployment Tax Break Worth 10 200 Here S How To Check For A Refund Fingerlakes1 Com

Millions Might Get A Refund With The 10 200 Unemployment Tax Break But Filing An Amended Return Could Unlock Even More Money Marketwatch

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

Unemployment Tax Refund Update What Is Irs Treas 310 Fox61 Com

How To Check The Status Of Your Unemployment Tax Refund R Irs

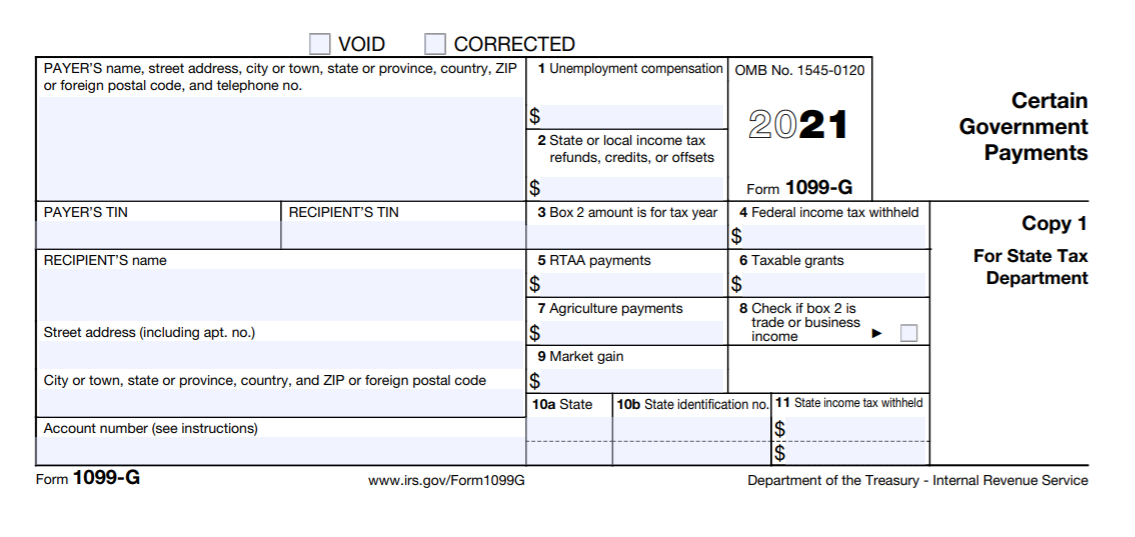

1099 G Unemployment Compensation 1099g

2020 Unemployment Tax Break H R Block

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

When Will Unemployment Tax Refunds Be Issued King5 Com

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Irs Tax Refund Delays Persist For Months For Some Americans 6abc Philadelphia

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Unemployment Tax Refund When Will I Get My Refund

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May